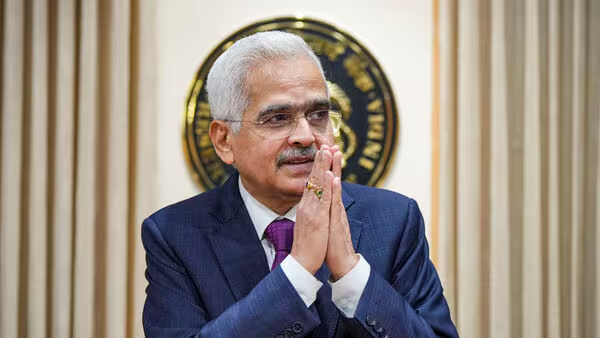

In a move set to transform the lending landscape in India, Reserve Bank of India (RBI) Governor Shaktikanta Das announced the upcoming nationwide launch of the Unified Lending Interface (ULI) platform on August 26. This announcement was made during the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bengaluru.

RBI Governor Shaktikanta Das Unveils Unified Lending Interface (ULI): Key Highlights

- Nationwide Launch of ULI Platform: RBI Governor Shaktikanta Das announced the nationwide rollout of the Unified Lending Interface (ULI) on August 26, during the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bengaluru. This platform aims to transform India’s lending landscape, particularly benefiting small and rural borrowers.

- Inspired by UPI’s Success: Similar to how the Unified Payments Interface (UPI) revolutionized digital payments, ULI is expected to bring a significant change to the lending sector. Governor Das referred to the integration of JAM (Jan Dhan-Aadhaar-Mobile), UPI, and ULI as a “revolutionary step forward in India’s digital infrastructure journey.”

- Streamlined Credit Appraisal: The ULI platform is designed to make the credit appraisal process faster and more efficient. It enables a seamless and consent-based flow of digital information, such as land records, between state databases and lenders. This reduces the time and documentation required for credit approvals, particularly for borrowers in rural areas.

- Plug-and-Play Integration: ULI features common and standardized APIs, allowing for easy integration with various technical systems. This ‘plug-and-play’ approach simplifies the credit process, ensuring borrowers can access credit more quickly and with minimal hassle.

- Addressing Unmet Credit Demand: By digitizing access to both financial and non-financial data that were previously siloed, ULI is expected to meet the substantial unmet demand for credit, especially in the agricultural and MSME (Micro, Small, and Medium Enterprises) sectors.

- Commitment to Financial Sector Strength: Reflecting on the success of UPI, Governor Das highlighted India’s robust digital payments ecosystem and reiterated the RBI’s commitment to strengthening the financial sector. He emphasized ongoing efforts to make the financial system stronger, more responsive, and customer-centric.

- Impact on India’s Lending Ecosystem: With the introduction of ULI, India is set to make significant strides in ensuring that credit is more accessible, particularly to those in need. This initiative is expected to further strengthen the country’s financial ecosystem.